What are FICA Taxes? Social Security & Medicare Taxes Explained

Por um escritor misterioso

Last updated 06 julho 2024

Federal taxes for Social Security and Medicare (FICA) are mandatory, so understanding them is important for all HR professionals. Here’s what you need to know.

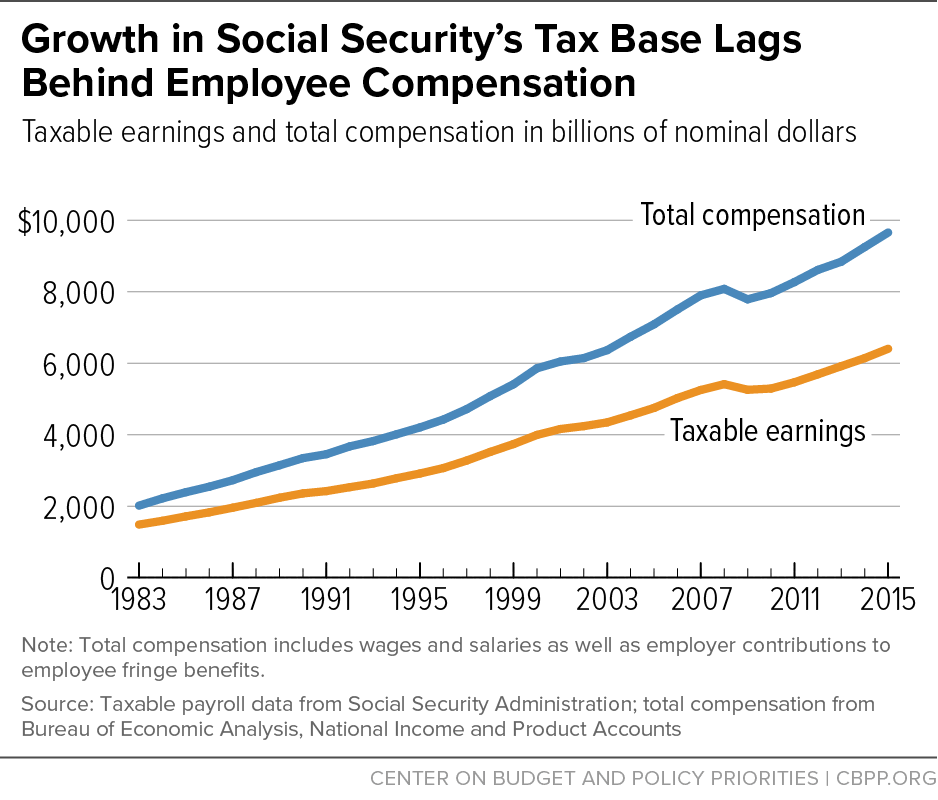

Distributional Effects of Raising the Social Security Payroll Tax

Increasing Payroll Taxes Would Strengthen Social Security

How Avoiding FICA Taxes Lowers Social Security Benefits

What Is FICA Tax? A Complete Guide for Small Businesses

FICA: Definition, 2022 Rates and Limits, Rules for Self-Employed

What are the major federal payroll taxes, and how much money do

What is a payroll tax? Payroll tax definition, types, and

Are federal and state taxes withheld as a percentage of your pay

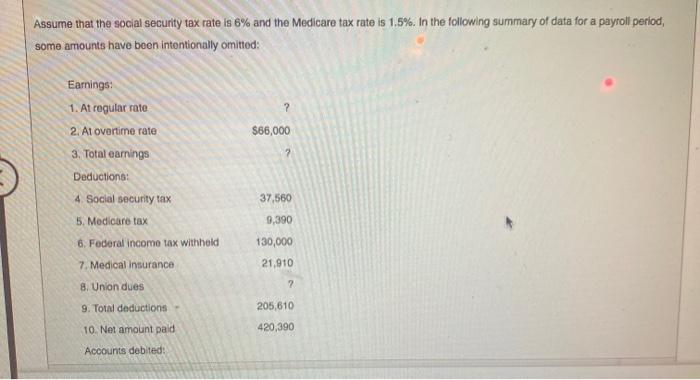

Solved Assume that the social security tax rate is 6% and

Social Security and Medicare • Teacher Guide

Recomendado para você

-

What are FICA Taxes? 2022-2023 Rates and Instructions06 julho 2024

-

What is Fica Tax?, What is Fica on My Paycheck06 julho 2024

What is Fica Tax?, What is Fica on My Paycheck06 julho 2024 -

What is the FICA Tax and How Does It Work? - Ramsey06 julho 2024

What is the FICA Tax and How Does It Work? - Ramsey06 julho 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks06 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks06 julho 2024 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?06 julho 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?06 julho 2024 -

Solved 2016 FICA Tax Rates 1 1 FICA taxes include Social06 julho 2024

-

How An S Corporation Reduces FICA Self-Employment Taxes06 julho 2024

How An S Corporation Reduces FICA Self-Employment Taxes06 julho 2024 -

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax06 julho 2024

What is FICA Tax and How to Calculate FICA Tax - Dancing Numbers Tax06 julho 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.06 julho 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.06 julho 2024 -

FICA Tax - An Explanation - RMS Accounting06 julho 2024

FICA Tax - An Explanation - RMS Accounting06 julho 2024

você pode gostar

-

CONJUNTO DE BEBÉ Calção + Camisa «Xadrez»06 julho 2024

CONJUNTO DE BEBÉ Calção + Camisa «Xadrez»06 julho 2024 -

Conheça os principais jogos de empreendedorismo - Rock Content06 julho 2024

Conheça os principais jogos de empreendedorismo - Rock Content06 julho 2024 -

Roblox Boys Graphic Short Sleeve T-Shirt Sizes 4-1806 julho 2024

Roblox Boys Graphic Short Sleeve T-Shirt Sizes 4-1806 julho 2024 -

Ferrari 488 Spyder 2018 por R$ 3.300.000, Curitiba, PR - ID: 632667806 julho 2024

Ferrari 488 Spyder 2018 por R$ 3.300.000, Curitiba, PR - ID: 632667806 julho 2024 -

G1 - G1 jogou: No PS4 e XOne, 'Diablo III' tem sua versão mais06 julho 2024

G1 - G1 jogou: No PS4 e XOne, 'Diablo III' tem sua versão mais06 julho 2024 -

![Bleach - Complete Series 5 [DVD] : Movies & TV](https://m.media-amazon.com/images/W/MEDIAX_792452-T2/images/I/51A4C9ESLLL._SR600%2C315_PIWhiteStrip%2CBottomLeft%2C0%2C35_PIStarRatingFOURANDHALF%2CBottomLeft%2C360%2C-6_SR600%2C315_ZA108%2C445%2C290%2C400%2C400%2CAmazonEmberBold%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_FMpng_BG255%2C255%2C255.jpg) Bleach - Complete Series 5 [DVD] : Movies & TV06 julho 2024

Bleach - Complete Series 5 [DVD] : Movies & TV06 julho 2024 -

Casa da Peppa 🐷 #peppapig #casadapeppapig #personalizados #papelaria06 julho 2024

-

Sonic The Hedgehog: Could Sticks The Badger Come To The Main06 julho 2024

Sonic The Hedgehog: Could Sticks The Badger Come To The Main06 julho 2024 -

Pin de Andy Guerch em códigos Netflix06 julho 2024

Pin de Andy Guerch em códigos Netflix06 julho 2024 -

Friday night Funkin: FNF Mods para Android - Download06 julho 2024

Friday night Funkin: FNF Mods para Android - Download06 julho 2024