What Are Open Market Operations (OMOs), and How Do They Work?

Por um escritor misterioso

Last updated 05 julho 2024

:max_bytes(150000):strip_icc()/Open-Market-Operations-OMO-Final-ec375b8eb4d44b4d80b7bb24c6f1c9f2.jpg)

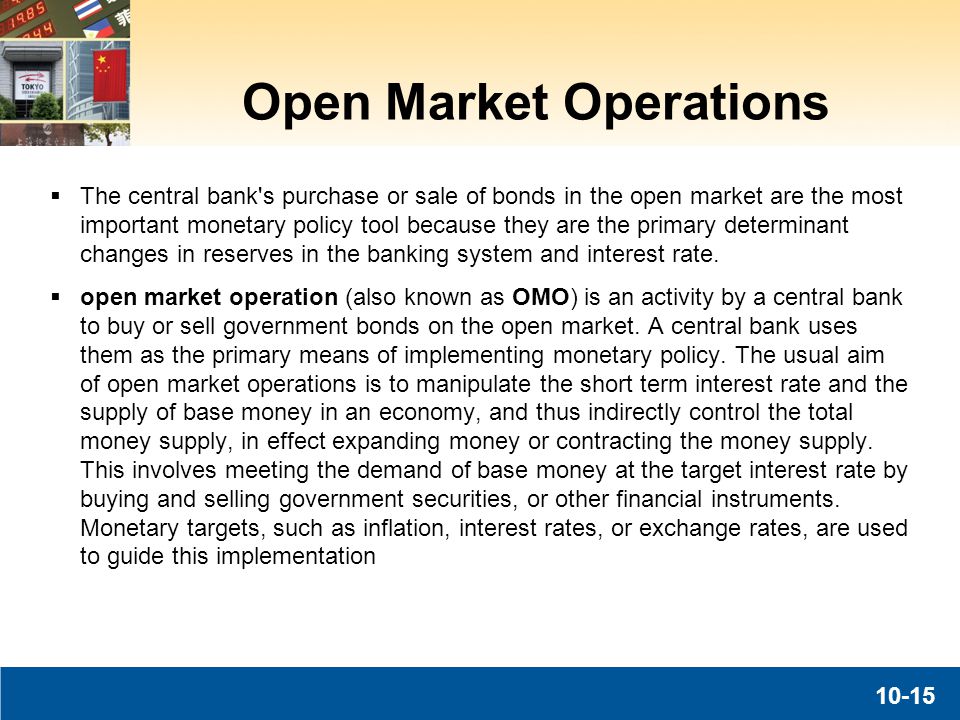

The Federal Reserve uses open market operations (OMO) such as buying or selling U.S. Treasuries to adjust the federal funds rate for monetary policy.

Introducing the Federal Reserve, Boundless Economics

open market operations –

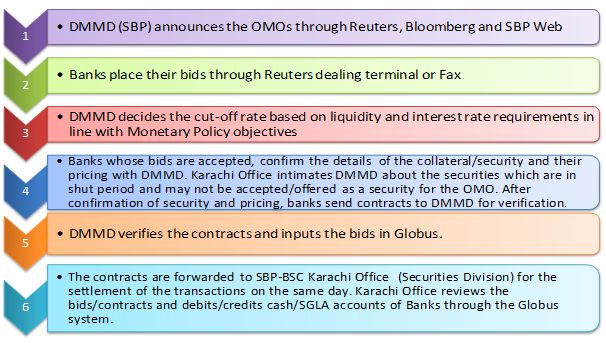

State Bank of Pakistan

Changes to the Reserve Bank's Open Market Operations, Speeches

Open Market Operations

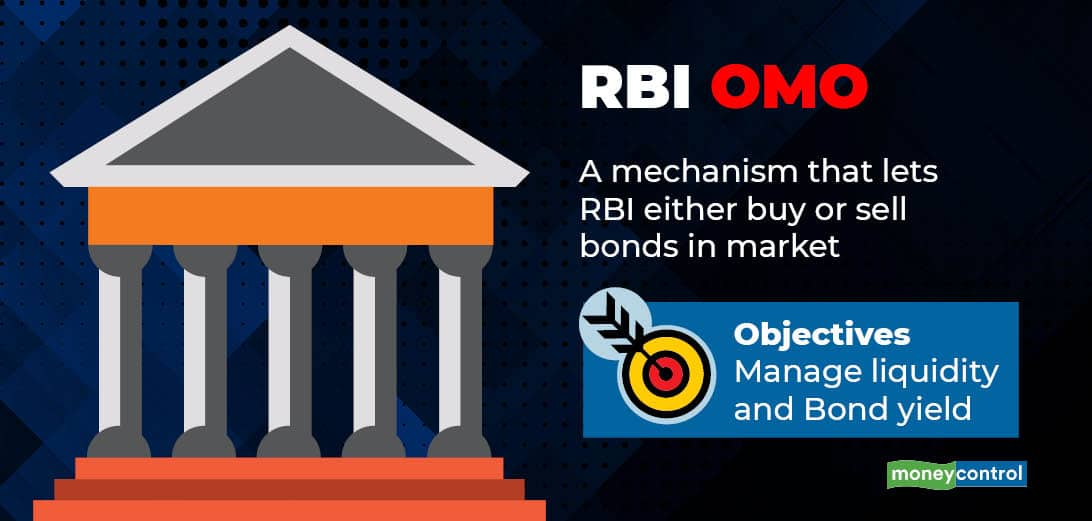

Why RBI's Open Market Operation plan caught the market by surprise

Monetary Policy and Open Market Operations

Solved You are Chair of the Federal Reserve Board. In your

What is an RBI OMO?

The Federal Open Market Committee (FOMC) – InvestoPower

RBI conducts OMO, Operation Twist for Government Securities: What

Chapter Preview “Monetary policy” refers to the management of the

Recomendado para você

-

Premium Vector, We are open sign concept05 julho 2024

Premium Vector, We are open sign concept05 julho 2024 -

yes-we-are-open-logo - PBS KVIE05 julho 2024

yes-we-are-open-logo - PBS KVIE05 julho 2024 -

open - City of Hubbard05 julho 2024

open - City of Hubbard05 julho 2024 -

What Stores Are Open on the 4th of July in 2023?05 julho 2024

What Stores Are Open on the 4th of July in 2023?05 julho 2024 -

New Year's Day 2023: Here is a list of what's open and closed - ABC7 Chicago05 julho 2024

New Year's Day 2023: Here is a list of what's open and closed - ABC7 Chicago05 julho 2024 -

Open system (systems theory) - Wikipedia05 julho 2024

Open system (systems theory) - Wikipedia05 julho 2024 -

Open Club Day 2021 – Open Club Day05 julho 2024

Open Club Day 2021 – Open Club Day05 julho 2024 -

open-152933_960_72005 julho 2024

open-152933_960_72005 julho 2024 -

:max_bytes(150000):strip_icc()/open_banking-final-8af075f74bb54196bbbd342f717e7716.jpg) Open Banking: Definition, How It Works, and Risks05 julho 2024

Open Banking: Definition, How It Works, and Risks05 julho 2024 -

What is open access?05 julho 2024

What is open access?05 julho 2024

você pode gostar

-

Inuyasha Fans - Brasil (@inuyashafansbra) / X05 julho 2024

Inuyasha Fans - Brasil (@inuyashafansbra) / X05 julho 2024 -

Anime Personality Types05 julho 2024

Anime Personality Types05 julho 2024 -

The Legend of Vox Machina The Tide of Bone (TV Episode 2022) - IMDb05 julho 2024

The Legend of Vox Machina The Tide of Bone (TV Episode 2022) - IMDb05 julho 2024 -

Ope Ope no mi (Op-Op fruit eaten by Trafalgar D. Water Law) | Sticker05 julho 2024

Ope Ope no mi (Op-Op fruit eaten by Trafalgar D. Water Law) | Sticker05 julho 2024 -

Resident Evil, Resident Evil 4 (2023), Resident Evil, HD wallpaper05 julho 2024

Resident Evil, Resident Evil 4 (2023), Resident Evil, HD wallpaper05 julho 2024 -

Ready Player One” a pretty, aimless film – The Collegian05 julho 2024

Ready Player One” a pretty, aimless film – The Collegian05 julho 2024 -

FIFA 18 OFFLINE PARA ANDROID/PSP COM COPA DO MUNDO RÚSSIA 2018 – DOWNLOAD05 julho 2024

FIFA 18 OFFLINE PARA ANDROID/PSP COM COPA DO MUNDO RÚSSIA 2018 – DOWNLOAD05 julho 2024 -

Karakuri Circus Season 2: Release Date, Characters, English Dubbed05 julho 2024

Karakuri Circus Season 2: Release Date, Characters, English Dubbed05 julho 2024 -

Railway Age Media Kit05 julho 2024

Railway Age Media Kit05 julho 2024 -

The homemade snake game: “Snakes and Ladders” never goes out of fashion – Coexistence05 julho 2024

The homemade snake game: “Snakes and Ladders” never goes out of fashion – Coexistence05 julho 2024